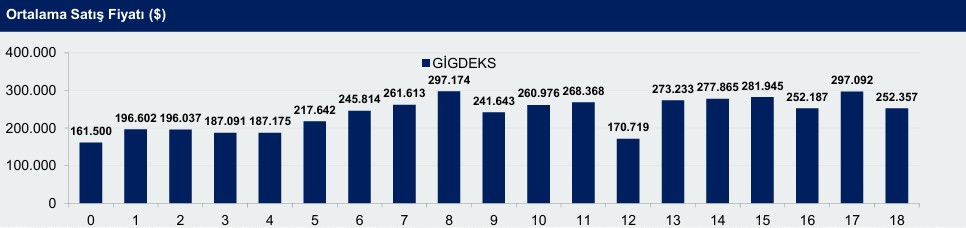

The 18th edition of GİGDEKS, the housing sales index for international investors prepared quarterly by the Real Estate Service Exporters Association (GİGDER) in collaboration with the brand and market research company AGS Global, has been published. According to the results covering the third quarter of 2025, a decline was observed in both the average sales price and the base index points.

According to GİGDEKS 18 results, the average sales price for international investors, which was $297,092 in the previous quarter, fell to $252,357 in the third quarter of 2025. This figure drew attention due to its close proximity to the $252,187 level recorded in GİGDEKS 16, covering the first quarter of 2025.,

Looking at quarterly developments, GİGDEKS fell to 156.3 points in the third quarter, down from 184 in the second quarter of 2025. Like the average sales price, the base points also hovered near the 156.2 level recorded in GİGDEKS 16.

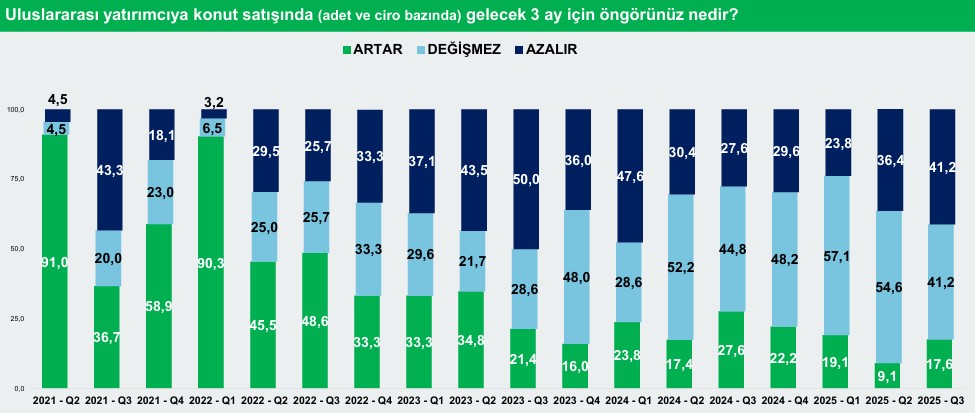

According to the survey, 41.2% of GİGDER members participating indicated that they do not expect any significant change in housing sales to international investors over the next three months. The proportion anticipating a decline in sales was also 41.2%, while only 17.6% expected an increase. These figures suggest that industry professionals are adopting a cautious approach for the upcoming period.

All GİGDER members participating in GİGDEKS 18 emphasized that the predictability and stability of government policies play a critical role in the decisions of international investors. This highlights that the reliability and sustainability of the investment environment directly influence investment preferences.

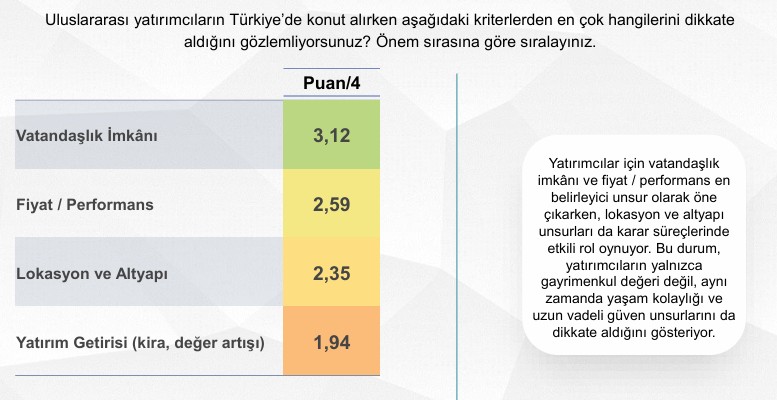

In GİGDEKS 18, GİGDER members were also asked which criteria international investors consider most when purchasing property in Turkey. According to the results, the leading factors influencing property choices in Turkey include citizenship opportunities, price/performance balance, location, and infrastructure availability. These findings indicate that investors value not only property value but also quality of life, accessibility, and long-term security factors.

GİGDER will continue to be the voice of industry representatives through its work! See you in the GİGDEKS 19 study, covering the fourth quarter of 2025.