The 17th issue of GIGDEKS, the international investor housing sales index prepared quarterly by the Real Estate Services Exporters Association (GİGDER) in collaboration with the brand and market research company AGS Global, has been published. According to the results covering the second quarter of 2025, a surprising increase was observed in the average sales price and base points.

According to the GIGDEKS 17 results, the average sales price to international investors, which was 252,187 USD in the previous quarter, rose to 297,092 USD in the second quarter of 2025. This figure stands out as the highest average sales price in GIGDEKS history since 297,174 USD recorded in the first quarter of 2023.

Looking at the quarterly development, GIGDEKS rose from 156.2 in the first quarter of 2025 to 184 points in the second quarter. This figure is one of the highest unit price base points in GIGDEKS history, with this level having been approached only once before (in GIGDEKS 8 during the first quarter of 2023).

According to the GIGDEKS 17 survey, 54.6% of GİGDER members stated that they do not expect any upward or downward change in housing sales to international investors over the next three months. On the other hand, the proportion of pessimists regarding sales was 36.4%, while optimists accounted for 9%. In the previous index, GIGDEKS 16, the proportion of pessimists was measured at 23.8%. This 12.6% increase is noteworthy.

In GIGDEKS 17, GİGDER members were asked, "What percentage of your housing sales to international investors in the second quarter of 2025 (April–May–June) were second-hand?" According to the data collected from GİGDER members, 31.7% of housing sales to international investors in the second quarter of 2025 consisted of second-hand properties. This indicates the presence of international investors' interest in second-hand housing in Turkey.

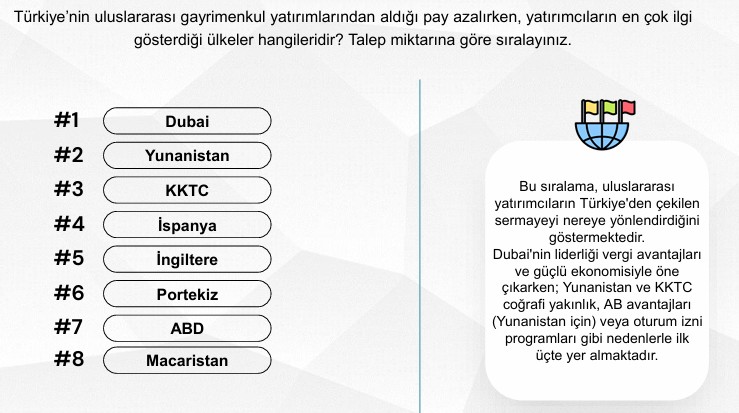

Finally, GİGDER members participating in the survey were asked which countries investors show the most interest in, as Turkey’s share in international real estate investments decreases. The responses, ranked by demand volume, are as follows:

- Dubai

- Greece

- KKTC

- Spain

- United Kingdom

- Portugal

- United States of America (USA)

- Hungary

According to the above ranking, Dubai’s leadership can be explained by its tax advantages and strong economy; meanwhile, Greece and the TRNC are thought to be in the top three due to geographical proximity, EU benefits (for Greece), or residency permit programs.

GİGDER will continue to be the voice of the sector representatives through its efforts!

Looking forward to meeting in the GIGDEKS 18 study, which will cover the third quarter of 2025.