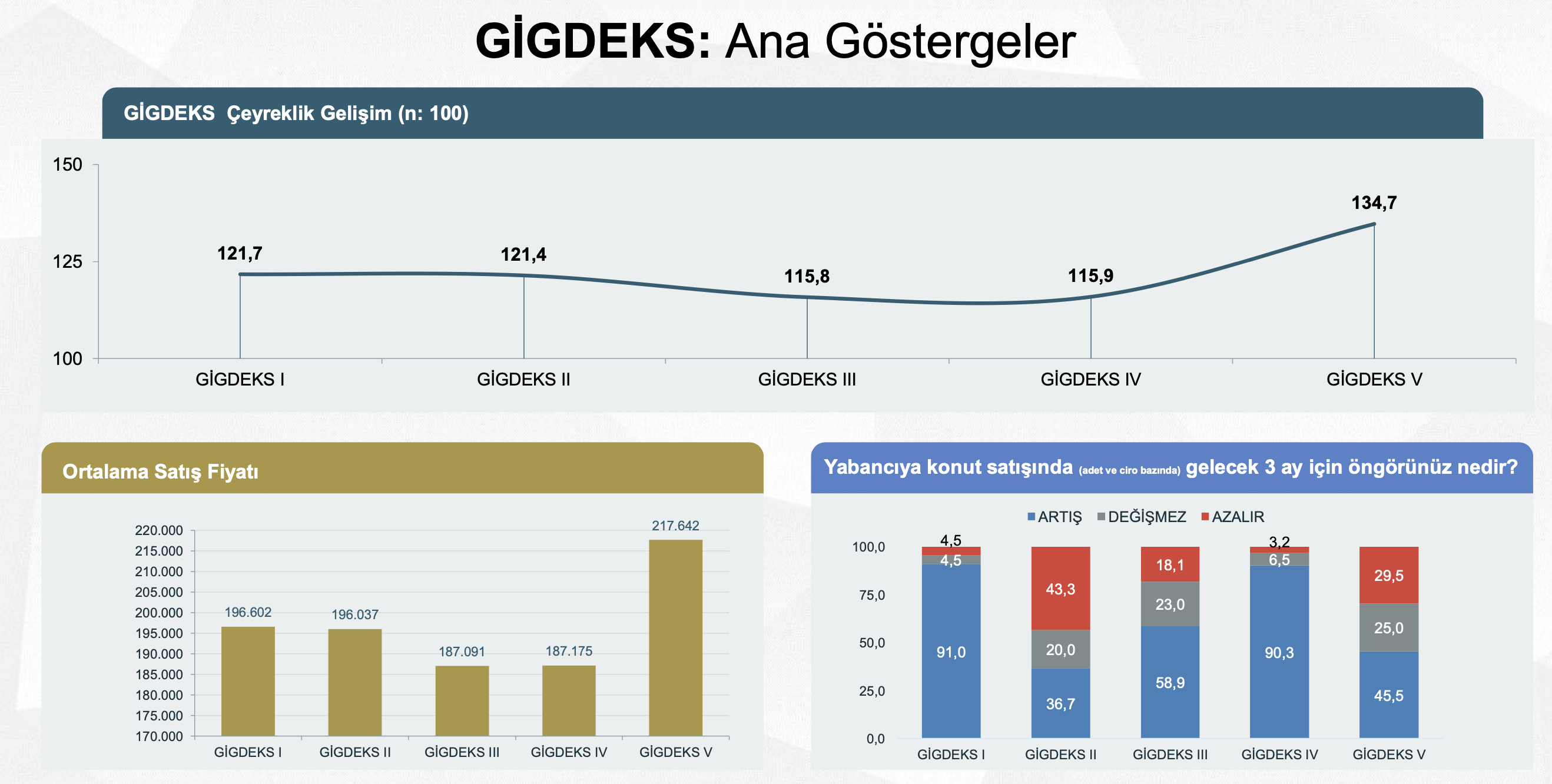

GIGDEKS, tracking the unit price of real estate sales to foreigners and the industry's trend for the next quarter, reached its highest level in history. According to GIGDEKS 5 data, the unit sales price, which was $187,175 in the previous quarter, surpassed the $200,000 threshold for the first time and reached $217,642.

The Real Estate Promotion Association Abroad (GIGDER), in collaboration with the brand and market research company AGS Global, published the 5th study of the foreign housing sales index GIGDEKS, examining the second quarter of 2022. The main agenda of this period, the regulation raising the investment amount for real estate in exchange for citizenship from $250,000 to $400,000, made a significant impact. The anticipation of the demand before the regulation came into effect also led to a rapid increase in GIGDEKS 5.

Accordingly, the index value, which was 115.9 in the previous quarter, reached its highest level since the first day with 134.7 in the second quarter covering April, May, and June of 2022. The unit sales price, which was $187,175 in the previous quarter, also surpassed the $200,000 threshold for the first time this quarter, reaching $217,642.

The decision to raise the access fee for Turkish citizenship in return for investment to $400,000, which came on the agenda in the second quarter of 2022, was negatively viewed by 50% of the industry representatives participating in the survey. However, 47.2% of the representatives found the regulation positive.

According to the members of GIGDER who consider the regulation positive, the increase in the purchase price for citizenship to $400,000 will strengthen branded housing producers and qualified real estate companies. Members expressing that the new value is an appropriate approach to macroeconomic conditions and housing prices in major cities anticipate that the regulation will have a positive impact on the total turnover and unit sales prices of the sector. They also expect the quality of the investor portfolio directed towards Turkey and the prestige of Turkish citizenship to increase.

On the other hand, the members who mostly found the regulation 'negative' believe that the increase in the value will reduce competitiveness against other countries, and investors will turn to different destinations. Expressing that sales may be negatively affected in a period of ongoing macro fragility, members state that frequent regulations can scare foreign investors, suggesting, 'Instead of a sharp transition, a gradual increase could have been made.'

A similar trend is also valid for the closure of neighborhoods to new residence applications. While 47% of the industry representatives participating in the survey answered the question 'What is your opinion about closing neighborhoods to new residence applications?' positively, 50% answered negatively. In other words, one out of every 2 participants evaluated this practice as 'negative.'

In GIGDEKS 5, the trend of sector representatives who were very optimistic about foreign sales in the previous quarter and saw their hopes reflected in the numbers in this quarter seems to have weakened. Accordingly, the expression 'sales will increase,' which exceeded 90% in the first quarter of 2022, has now dropped to the 45% range in the second quarter of 2022.