According to GIGDEKS 3 data evaluating the last quarter of 2021, the average unit housing sales price to foreigners, which was $196,037 in the previous quarter, decreased to $187,091 in the final quarter of 2021.

Prepared in collaboration with the brand and market research company AGS Global by the Foreign Real Estate Promotion Association (GIGDER), GIGDEKS 3 data covering the October-November-December period of 2021 reveals an increase in the number of foreign housing sales while the unit price declined. The average unit sales price of GIGDEKS, which was $196,037 in the previous quarter, dropped to $187,091 in the final quarter. When the average housing sales price determined by GİGDER in January 2021 as $161,500 is accepted as the base value (100 points), the GIGDEKS score, which reached 121.4 basis points in the previous quarter, decreased to 115.8 in the final quarter.

In the last quarter of the year, characterized by a dynamic economic agenda with fluctuations in the exchange rate due to low interest rates and a competitive dollar, the effects of exchange rate volatility were directly reflected in GIGDEKS data. With the appreciation of the currency and the increased purchasing power of foreign investors, they started to acquire the same housing at a lower cost, leading to a decrease in unit prices in terms of dollars.

Within the scope of the GIGDEKS 3 survey, where 39 GIGDER members answered various questions ranging from sales price to sales method and current industry expectations, the question "How much do you expect your company's sales to increase in 2022?" received the response from GIGDER members that they expect a "27.3% increase on a company-specific basis." While GIGDER members demonstrated performance above the Turkish average, this expectation was also anticipated in terms of quantity throughout the industry. Despite the sudden fluctuations and uncertainties in the exchange rate creating partially negative expectations in sales, the increasing returns of real estate, still considered the safest investment, maintained positive expectations for the sector.

Among the GIGDER member firms surveyed within the scope of GIGDEKS, 69.2% stated that the exchange rate volatility experienced in the last quarter negatively affected their sales, while the percentage of those expressing positive effects was 18%. The proportion of those stating that their sales were not affected by the fluctuation in the exchange rate remained limited at 12.8%.

The rise in the dollar was positively received in the sector in terms of increasing the tendency of foreign investors to purchase real estate in Turkey with an appreciating currency. However, the high variability of the exchange rate created uncertainty on the buyer's side. GIGDEKS 3 data showed that the unpredictability brought by sudden exchange rate changes even within two days could be a factor negatively impacting sales. While there might not be a decrease in quantity-based sales, a foreign buyer who purchased property at a high price during a period of high exchange rates might occasionally want to cancel the purchase, citing the high purchase price during the falling period.

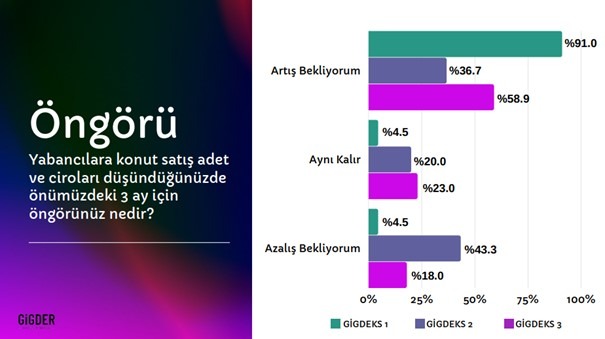

GIGDER members are looking more optimistically towards the next quarter, especially with the overcoming of issues in the real estate appraisal system. According to GIGDEKS 3 data, the percentage of those expecting an increase in sales in terms of quantity and turnover in the next quarter has risen again to 58.9% in the final quarter of the year, after reaching 91% in the second quarter, dropping to 36.7% in the third quarter.

According to the Housing Price Index published by the Central Bank in December 2021, based on the data from October, the annual total return on real estate is reported to be 45.11%. This has further increased positive expectations. Looking at the average annual total return on real estate investments in Istanbul over the retrospective 11-year period, it stands at 19.72%, surpassing the returns of financial investment tools such as the dollar, euro, and deposits. Real estate in Turkey maintains its position as a favored investment for both domestic and foreign investors due to its reliable and consistent returns, emerging as a safe haven globally. Despite everything, these data are refreshing confidence in the sector.